6 things to consider if you are planning to come to Spain

Starting a new life in Spain can be very exciting and we want you to enjoy your new start. Here comes six tips to help you:

1- Review your investments in your country of origin. Maybe the investments that you have in your country are tax efficient there but they don’t work in Spain.

2- Be aware that in Spain there is no concept of a partial tax year. That means that you can only be a tax resident or not tax resident for all the tax year. Check your status because as a tax resident you pay taxes on your worldwide income.

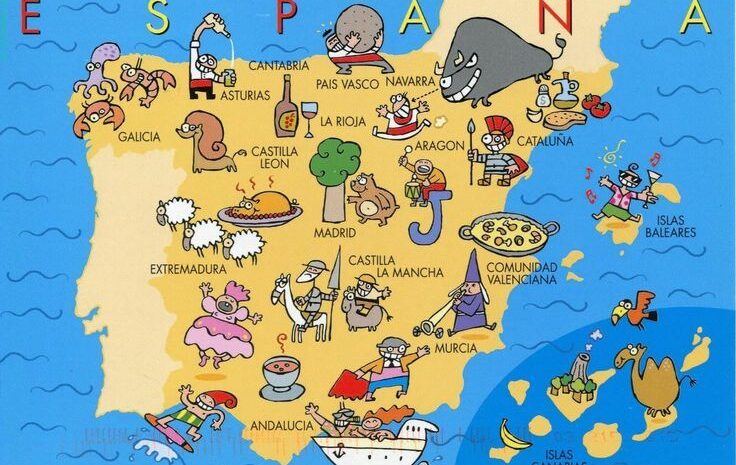

3- A good tax planning must consider Inheritance tax. Inheritance tax change in each region of Spain. You should know that in Spain there is inheritance tax between spouses.https://www.impley.com/significant-changes-in-the-inheritance-and-donation-tax-in-the-valencian-region/

4- Social Security registration is compulsory if you work in Spain or from Spain. Digital nomads living in Spain must be registered as self-employed and pay Social security. https://www.impley.com/major-changes-to-freelancers-social-security-contributions/

5- Have you heard horrible stories about buying properties in Spain? In many cases they are true. Find a good solicitor to review the urban status before buying a property in Spain. https://www.impley.com/due-diligence-when-buying-a-property-to-avoid-complications/

6- Spanish income tax may look scary for you. But just remember, we are in Europe and taxes are very similar around the country.